Why Divest?

UI System Investments FY 2022

In Fiscal Year 2022, the University of Illinois System reported over $120 million worth of corporate debt held in 52 companies (about 12% of the operating pool corporate bond ownership) that profit from the extraction, transportation, or combustion of coal, petroleum, or natural gas. In total, the University of Illinois System’s operating pool is responsible for financing 86,000+ metric tons of C02 emissions (calculated as total carbon emissions) as of FY 2022. Of these emissions, 66,000+ metric tons of C02 come from fossil fuel companies. The math is simple: by divesting the 12% of investments in fossil fuel companies, the University of Illinois System would cut its carbon footprint by 78%.

As per the EPA's Greenhouse Gas Emissions Calculator, the negative environmental impact of University of Illinois System's investments in fossil fuel companies is equivalent to the greenhouse gas emissions from 14,754 gasoline-powered passenger vehicles driven for one year or 12,900 homes' electricity use for one year, and the positive environmental impact from institutional divestment is equivalent to the carbon emissions avoid by recycling 2,869,790 trash bags of waste or the carbon sequestered by 1,096,258 tree seedlings grown for 10 years.

We classify fossil fuel companies as public corporations that operate in the Oil & Gas (O&G) Exploration & Production, O&G Equipment & Services, O&G Integrated, O&G Midstream, O&G Refining & Marketing, Other Industrial Metals & Mining, and Diversified, Independent Power Producers, Regulated Electric, and Regulated Gas Utilities industries.

66,299 Metric Tons of CO2 is Equivalent to

GREENHOUSE GAS EMISSIONS FROM:

GREENHOUSE GAS EMISSIONS AVOIDED BY:

CO2 EMISSIONS FROM:

CARBON SEQUESTERED BY:

What are Fossil Fuels?

Fossil fuels are a source of energy derived from a hydrocarbon-containing material such as coal, oil, and natural gas; formed naturally from organic matter that has been buried and transformed over millions of years. There is scientific consensus that climate change is driven by anthropogenic forces, with the main driver being the burning of fossil fuels for energy.

“The Clock’s Deadline tells us that, at current rates of greenhouse gas emissions, we have less than eight years left in our global “carbon budget” that gives two-thirds chance of staying under the critical threshold of 1.5°C of global warming.” Source: https://climateclock.world/

What Does 1.5C Warming Mean?

A temperature increase of 2 °C by the year 2100 would mean 5 times the floods, storms, drought and heat waves as there are now. This means increased risks of local species extinction, catastrophic biodiversity loss and great detriment to food security. Terrestrial, wetland and ocean ecosystems that serve all life, including humans will experience severe changes to everyday life. Human migration and climate refugee situations are already underway1.

The Case for Fossil Fuel Divestment

Institutional Investment is the practice of organizations putting their large pools of money into return generating assets on behalf of their members. Institutional investors purchase a wide range of resources, ranging from stocks, bonds, real estate, commodities, to alternative investments. The asset allocation relies on the organization’s mission and goals, risk tolerance, outlook on the market, and social and environmental factors. Investment committees will work with managers to monitor investments and periodically review their objectives and financial needs.

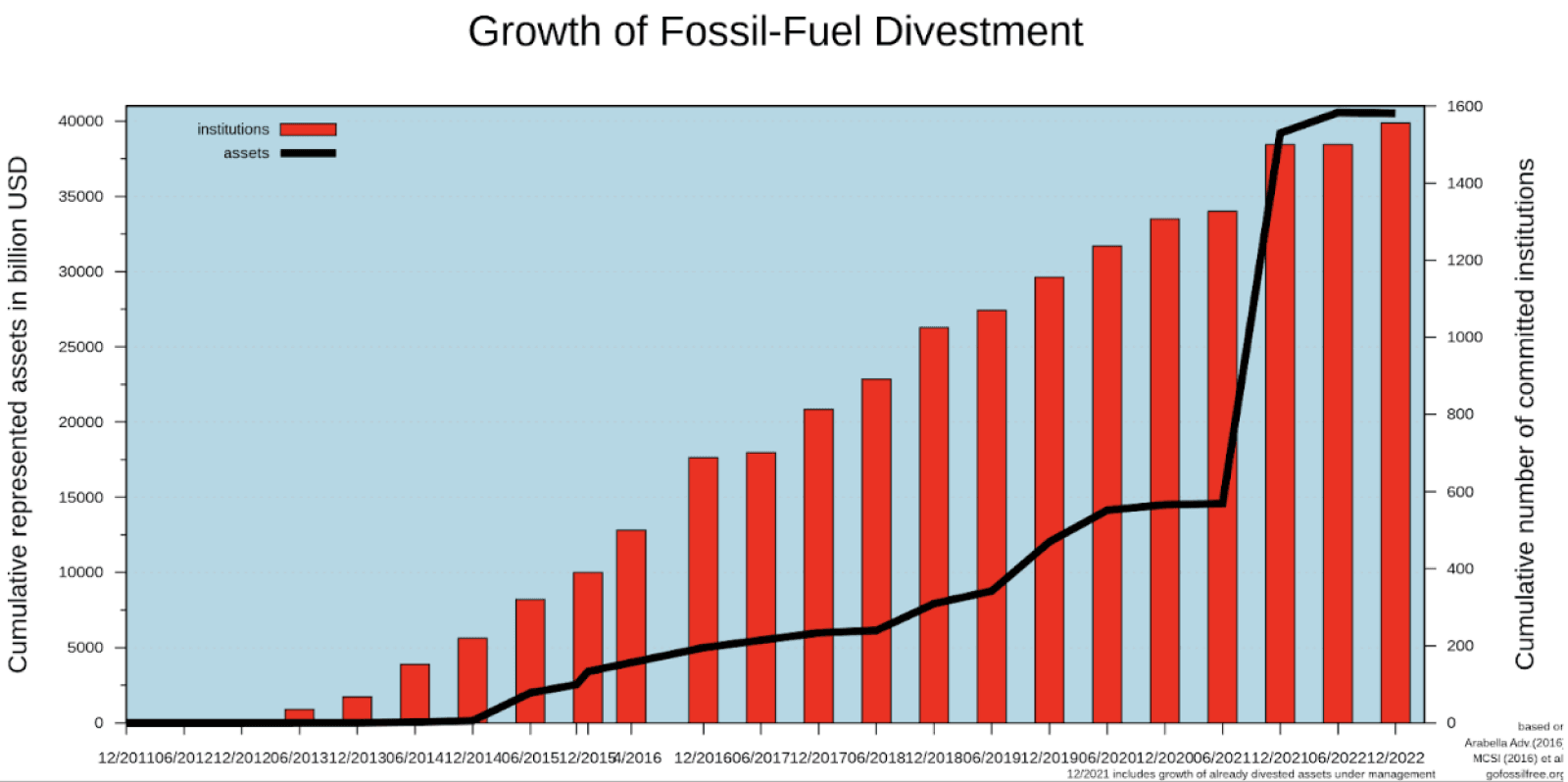

Institutional fossil fuel divestment is the process or organizations selling off assets in companies that profit from the extraction, transportation, or combustion of coal, petroleum, or natural gas. The goal of fossil fuels divestment is to reduce climate change by exerting social, political, and economic pressure on fossil fuel companies.

Cases for Divestment

Source: https://divestmentdatabase.org/

According to the Institute for Energy Economics and Financial Analysis (IEEFA), financial impairment concerns have been debunked by major investment advisors. New York City comptroller Thomas P. DiNapoli requested research reports be done to inform and secure the city’s pension fund investments. BlackRock and Meketa independently deduced that divested funds have experienced no negative financial consequences, finding solely instances of neutral or positive returns.

There is merit to the claim that failure to divest is unlawful under the 2020 Illinois Sustainable Investing Act (ISIA) and the Uniform Prudent Management of Institutional Funds Act (UPMIFA). In fact, the UIS cites these two pieces of policy in their 2021 Investment Policy Statement suggesting that they do, in fact, intend to adhere to this legislation.

The moral case for fossil fuel divestment is founded on the belief that investing in fossil fuel companies perpetuates an industry that harms the environment and human health. By investing in fossil fuel companies, institutions are contributing to the exploitation of vulnerable communities, worsening climate change, and contributing to pollution, which has a disproportionate impact on marginalized communities.

Source: "Fossil Fuel Divestment." 350.org, 350.org/our-work/divestment/

Schools That Have Divested

- American University

- Brandeis University

- Brevard College

- Brown University

- California Institute of the Arts

- California State University, Chico

Governments & Pension Funds That Have Divested